What is common across HUL, Flipkart, Marriott, Hyundai, Volkswagen, L’Oréal, Aditya Birla Fashion & Retail, Pepsico?

All have multiple brands in the same product category targeting overlapping segments and a degree of cannibalization of sales within the brands! But why do companies adopt this and does this succeed?

There are many companies in FMCG/B2C space, who have multiple brands in the same product category which overlap each other in adjacent segments, thus competing with each other, while with competing other companies. Is it really possible for this approach to be successful? Why do companies adopt this strategy?

Some of the companies which have adopted this successfully:

HUL - Lux, Dove, Pears for beauty soaps and similar approach for other categories

L’Oréal Groupe- L'Oréal, Garnier for Haircare and Hair color

Flipkart - Flipkart, Myntra for Ecommerce in Apparel

Hyundai Group - Hyundai, Kia for SUVs

Volkswagen Group - Volkswagen, Skoda, Audi for Luxury passenger vehicles

Xiaomi - Redmi, Xiaomi, POCO for Mobile phones

Aditya Birla Fashion and Retail - Allen Solly, Peter England, Louis Phillippe in Apparel Retail

Pepsico foods- Lays, Doritos, Cheetos in chips/snacks

Marriott International - J W Marriott, Ritz Carlton, St Regis as Classic Luxury Brands, Courtyard by Marriott, Fairfield, Series (The Fern) being Midscale brands and similar approach for other categories in Hotels

Tata Consumer products - Tata Tea Premium, Tata Tea Gold in Tea

And more…

We will discuss a few of the above examples in some detail and then distill the learnings.

A. HUL soaps - Lux, Dove, and Pears are all beauty soap/skin cleansing brands owned by Hindustan Unilever (HUL)

1. Positioning Differences

Lux → Traditionally “the film star’s soap,” positioned as glamorous, affordable beauty soap for the Aspirational mass market, especially middle-income consumers. Priced at around Rs 60 to 65/-

Dove → Premium, dermatologically tested, positioned on moisturizing and care rather than glamour, Upper-middle class, urban consumers willing to pay more for skincare benefits. Prices at around Rs 70 to 85/

Pears → Gentle, transparent, heritage brand associated with mildness and purity. Niche consumers who value tradition, purity, and gentleness. Priced at around Rs 80 to 90/-

HUL deliberately allows overlap - If one consumer shifts preference (say from Lux to Dove as income rises), they stay within HUL’s portfolio. They compete with each other on the shelf, but the bigger idea is to crowd out competitors and capture different consumer needs, price points, and emotional territories.

B. Hyundai and Kia for SUVs

Hyundai and Kia are part of Hyundai Motor Group, but Hyundai has deliberately kept Kia as a separate company/brand

1. Brand Positioning Differences

Hyundai → Mainstream, practical, reliable, good value for money. Targeting Broader, conservative buyers (family-first, middle-class appeal)

Kia → Sportier, youthful, design-driven, slightly more adventurous image. Targeting - Younger, more style-conscious buyers who may want something “cooler.”

2. Competitive Shielding - If a customer rejects Hyundai for being “too common” or “too plain,” Hyundai Motor Group still has a chance to capture them through Kia. It’s the same logic as HUL: better to cannibalize yourself than let Toyota, Mahindra or Maruti or Tata take that share

3. The difference - Unlike HUL’s brands (Lux, Dove, Pears) which are under one company’s umbrella marketing, Hyundai and Kia operate as independent legal entities with separate dealerships, marketing strategies, and pricing freedom and the brand stories are different. But both share platforms, engines, and R&D!

Combined market share of Hyundai and Kia in passenger vehicles India is 20-21% (24% in SUV share) makes them clear No. 2 (in both overall PVs and SUV segment), far higher than the no.3 (13% in PV and 19% in SUV segment).

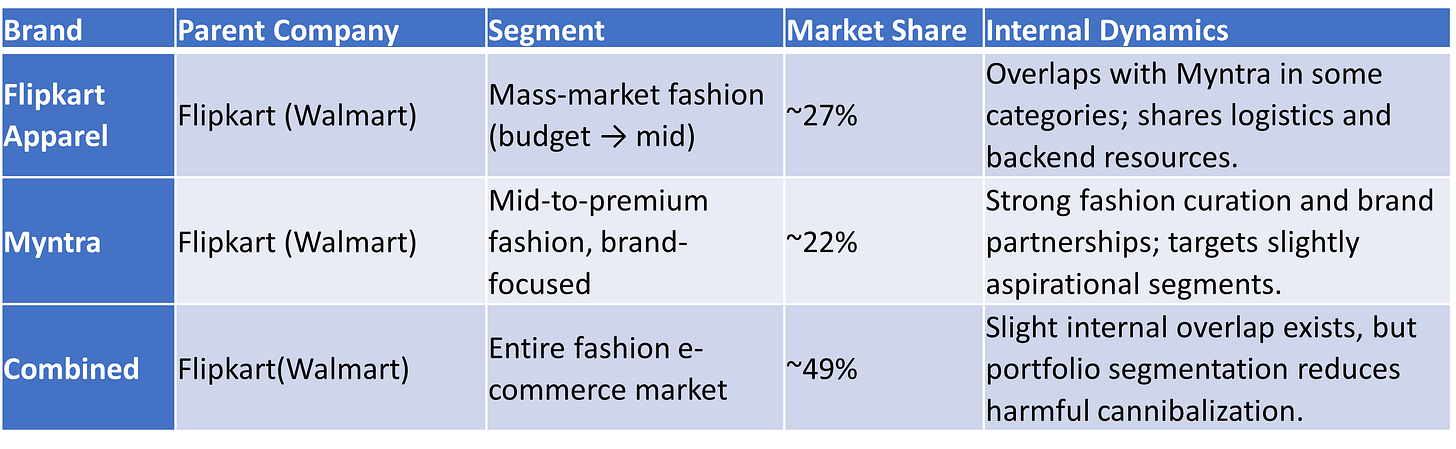

C. Flipkart and Myntra in Apparel

Slightly different pricing and discount strategies

But share common backend logistics

Have different loyalty programs - Flipkart Plus and Myntra Insider - but loyalty points can be earned on one can be redeemed on either!

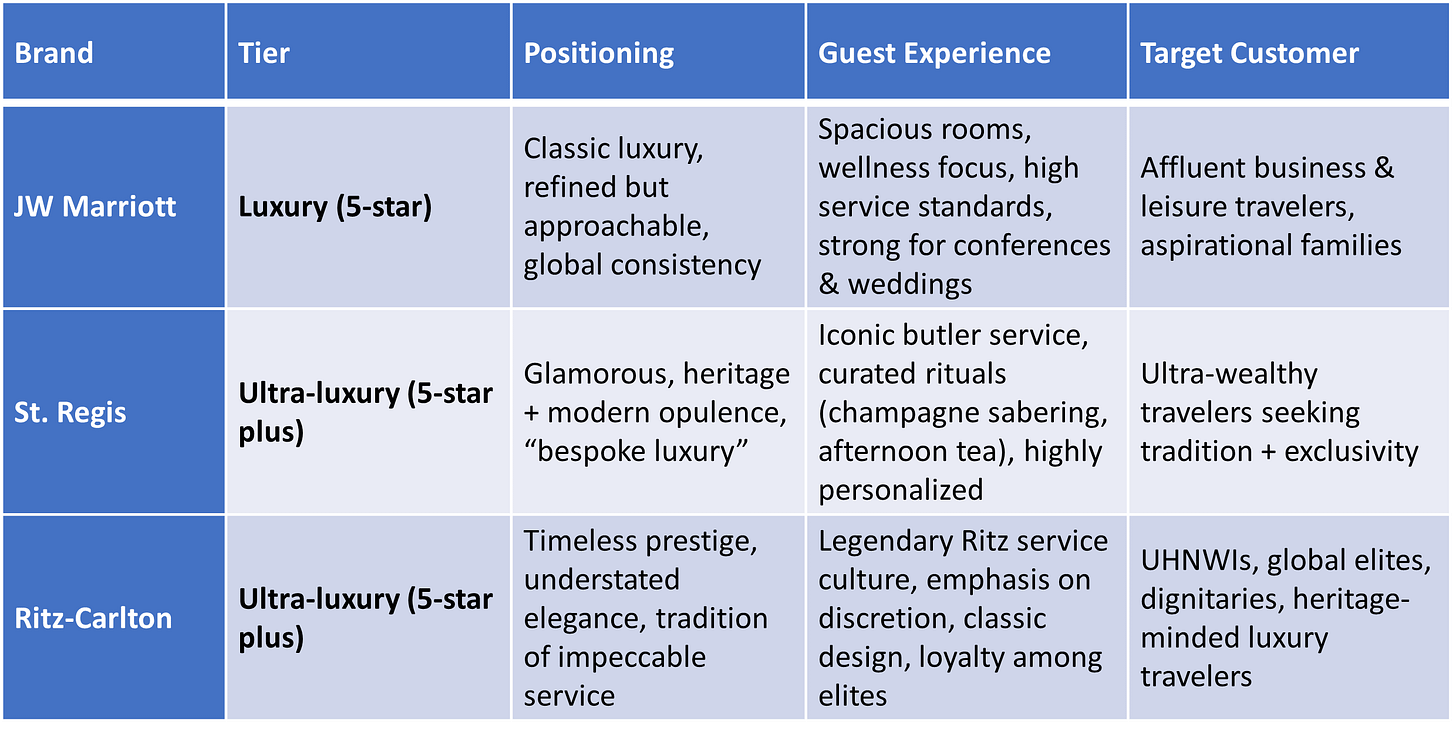

D. JW Marriott, St. Regis and Ritz-Carlton are Luxury Hotels in Marriott portfolio

Do they compete?

Marriott carefully differentiates JW Marriott, St. Regis, and Ritz-Carlton to reduce cannibalization as we see in the table above. But there is overlap

Same city presence

In New York, Dubai, or Shanghai a wealthy traveler could choose between JW, St. Regis, or Ritz

For a high-spending corporate client/Wedding Event, JW, St Regis and Ritz might be substitutes

Aspirational shift - A frequent JW guest may “upgrade” to St. Regis or Ritz for special occasions (honeymoon, celebration).

Both lead to some level of internal competition, - But by design, the principle, better they “trade up/down” within Marriott than go to Four Seasons or a Hyatt

Unified Customer programs -

Common Loyalty program - Marriott Bonvoy - Earn on any Marriott brands and spend on any Marriott Brands

Common Booking engine across brands - Enables comparison by offering wide choices/rates/facilities within Marriott portfolio

The core objective

Capture the entire travel wallet of a customer across different occasions. - Same businessperson may stay at Courtyard during work trips, JW for family vacation, Ritz for honeymoon/anniversary.

Create a ladder of aspiration — Courtyard guests aspire to move up to JW or Ritz as income rises

Distilling the learnings from the above Examples - Horizontal Multi-Branding

The Core Idea - Large firms deliberately launch multiple brands within the same category (FMCG, cars, apparel, hotels, e-commerce). This creates potential internal competition, which at first glance looks wasteful (cannibalisation). But when managed well, it expands market share

Objectives

Maximize portfolio market share, block competitors, and capture micro-segments

Driving Economies of scale through shared resources:

Flipkart and Myntra share logistics, technology backbone, seller ecosystem

Hyundai and Kia share platforms, Engines, and R&D

HUL - Common distribution network, Media buying, display spaces

Marriott - Unified loyalty program, Common reservation engine

ABFRL- Shared sourcing and textile supply chains

2. Cannibalization within brands is by design, Managed via differentiation

Segment Coverage - Brands straddle across segments to cover entire market - Differentiation of brands could be price, features, emotional positioning, or persona

Overlap ensures coverage of adjacent segments seamlessly and thus capturing higher overall market share and prevent competitors from gaining share

Encourages Brand Switching within the Portfolio

Consumers may start at an entry brand and trade up within the portfolio. Cannibalisation thus also becomes a growth ladder

Customers movement up or down within the group/company, ensures high lifetime customer value for the company

Scale Matters - Large players can absorb and manage some level of internal cannibalization, better than smaller players

3. Customer Micro-Segmentation is the real enabler - Deep understanding of consumer needs, willingness to pay, lifestyle, psychographics etc. allows portfolio brands to coexist without destructive competition

Bottom Line

Companies like HUL, Hyundai–Kia, Marriott, Flipkart–Myntra, and others succeed with horizontal multi-brand strategies because they:

Use controlled cannibalisation to occupy every consumer segment

Create internal fences (price, benefit, lifestyle, channel) that minimise brand confusion

Cannibalisation here is not a weakness — it is a defensive moat and a growth engine

On a parting note: If the Brands are not managed carefully, one could end up “cannibalising (In the literate sense) each other” - In the early 1990s, Voltas attempted the same approach for its Refrigerator Business. It was selling refrigerators under Voltas brand name from 1984. In 1992, it acquired Hyderabad Allwyn, to leverage the strong "Allwyn" brand in Southern India and thus grow. Both Voltas and Allwyn operated as as independent profit centers with own manufacturing, dealers, marketing, brands (Similar to Hyundai-Kia). But both started competing against each other rather than with Godrej, Kelvinator, BPL, Videocon, LG. Both divisions would poach each other’s personnel, dealers, undercut each other in price, credit policies, incentives, display etc. This led Voltas’s Refrigerator business into deep losses with negligible market share gain. In 1998, Voltas sold its refrigerator business to Electrolux and exited selling refrigerators completely. (Voltas has relaunched refrigerators under Voltas Beko brand in 2019 under a new JV).

Thank you for reading The Chai and Charts Chronicles. To read any of our earlier 80 posts, you can click https://chaiandcharts.substack.com/archive. You can share your feedback on the comments section of the post or by email - menghrajani1@gmail.com