Is India's largest private bank experiencing prolonged pangs of Indigestion?

Why is HDFC Bank India's largest Private Bank, experiencing prolonged pangs of Indigestion due to "merger" of HDFC Ltd with itself and how long before it can say "fully cured" of the indigestion?

HDFC Ltd and HDFC Bank Ltd. announced its intention to merge on April 4, 2022 and the merger was effective 1st July 2023. It is India Inc’s largest M&A. Any M&A results in teething troubles in the resultant entity, but is this merger resulting into prolonged pangs of indigestion? What is this indigestion and is it hurting HDFC Bank and is the pain likely to prolong?

HDFC Ltd was the largest NBFC(Non Banking Finance co.) in India primarily in Mortgages & Real Estate loans. Pre-merger HDFC Bank on 30th June 2023 was a Rs 25 lac crore balance sheet. Post merger, the combined HDFC Bank was a Rs 37 lac crore balance sheet an increase of 50%. It was a merger of 2 very large financial Institutions, but with a very different Asset & Liability mix.

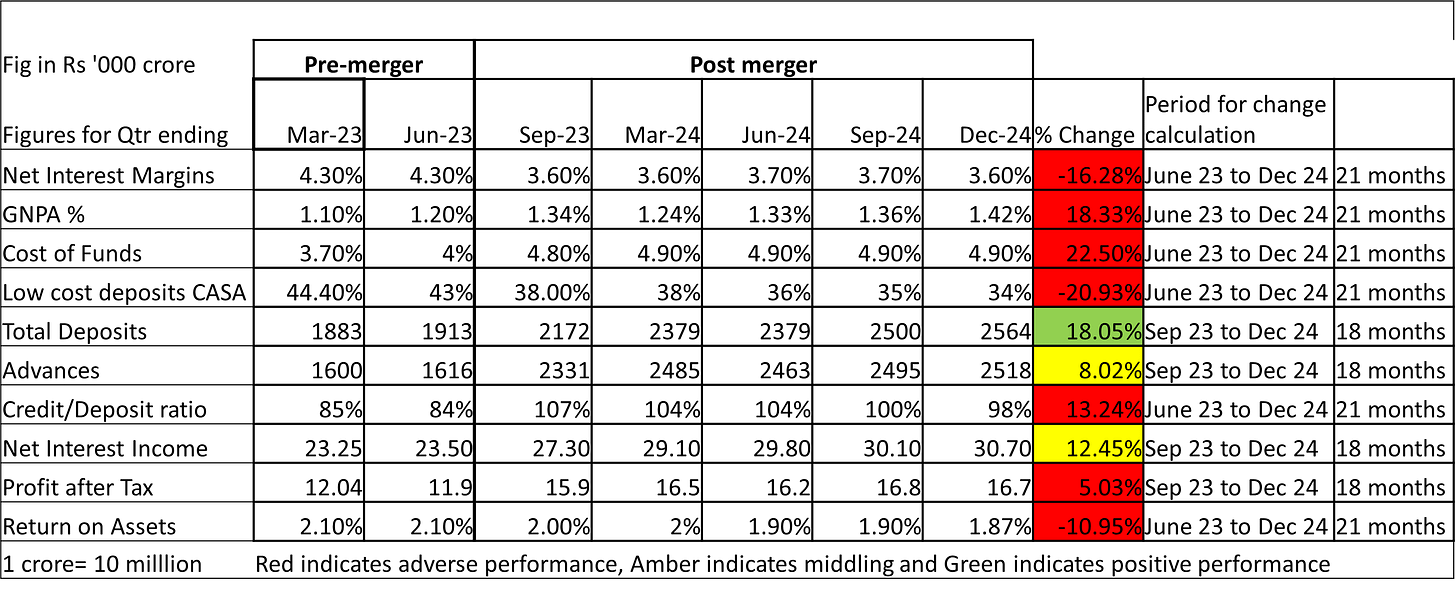

HDFC Bank performance Pre and Post Merger - A snapshot

An overview as seen in the table below, shows drop in performance on key parameters as compared to its own performance in pre-merger period.

The % change in performance of HDFC Bank on most of the above parameters is also lower than ICICI Bank in the same period of time. Is it due to Indigestion?

External context

RBI had been increasing the Repo rates from May 2022 to February 2023 and post that rates were stable till February 2025. From external perspective, interest rates were stable throughout the period we are analysing.

Net Interest Margins - Gross Margins

In a high interest rate scenario, the NIMs tend to reduce with a lag as the cost of funds increases for a bank. Most loans are given at floating rate of interest whereas most deposits are at fixed rate of interest. So, till the higher interest rate regime remains, banks tend to earn lower NIMs progressively. In case of HDFC Bank, the NIMs have fallen by 16% in the period April 2023 to December 2024, whereas ICICI Bank had reported fall off 9%. HDFC Bank faced the squeeze, because of multiple reasons:

HDFC Ltd had higher cost of funds due to NBFCs not having access to Low cost Current/Savings A/cs.

HDFC Ltd. was primarily in home loans which are amongst the cheapest loans

Thus the merger immediate impact of the merger was addition of higher cost borrowings and lower spreads

This was compounded by the fact that the post merger period was a high interest rate regime and margins were under pressure for the Banking Industry.

But there are other reasons for lower NIMs of HDFC Bank.

Credit Deposit Ratio (CDR)

A Bank maintains between 80-85% CDR as it has to provide for CRR and SLR. HDFC Ltd being an NBFC had no such requirements. A Bank’s main source of funding is deposits, whereas an NBFC relies on Bank loans, NCDs, forex borrowings and if permitted Deposits. HDFC had a large depositor base, but had multiple other sources of borrowings. Due to the merger therefore the CDR increased to 110% against 85% that HDFC Bank had in pre-merger period. This skew led HDFC Bank to follow 2 SOS strategies for correction in CDR:

Slowdown the numerator(Advances or Credit)

Rapidly increase the denominator - Deposits

Even after 18 months of following these twin strategies, HDFC Bank CDR was at 98% as of December 2024, well above 85%. In addition, these 2 strategies are likely to have a longer term negative impact of HDFC Bank financial health.

Slowing pace of Advances

HDFC Bank Advances has grown at 8% from July 2023 to December 2024. This is against the Industry including large Banks like SBI/ICICI growing advances at 17-20% in the same period. This slowing down strategy has partially resulted in reducing Interest Income growth to 12%. In lending, the advances generate revenues over 3 to 10 years, unlike in most other products/services where revenue is generated based on immediate activity. Hence, HDFC Bank Interest Income will continue to grow at slower pace for next couple of years, as lag effect of slow growth of advances strategy from Jul’23 to at least Sept’ 25 i.e. till CDR becomes < 90%. If the core interest income grows slowly, so is likely to be the growth in Profits (which is facing a double whammy)

Faster pace of Deposits

Amongst all key parameters in the table above, HDFC Bank has done “very well” on growing deposits at a faster pace than the Industry. But this is at a “huge cost”. The deposits are being raised at rates higher than peers and for longer tenures. From July 2023 to July 2024, HDFC Bank had amongst the highest rates for FDs in the 5 to 10 years period at 7.75%. Post July 2024, HDFC Bank pays 7.9% interest for 55 months(4.5 years). These rates are between 0.25% to 0.5% higher than most large peers in the same periods. In contrast, large Banks are paying 7.9% or 8% rates but for 1-2 years periods only. HDFC Bank was paying higher interest rates for longer tenure for a) Reducing CDR and b) improve the Asset Liability mix - Long tenure home loans need longer maturity liabilities. Also, CASA(low cost deposits) has fallen from 44% to 34%, a fall higher than the Banking Industry overall.

A part of the impact of this higher interest rates is increased cost of funds for HDFC Bank by 22% post the merger. HDFC Bank had been for long time(15+ years) conservative in FD rates with 0.25% to 0.5% lower than most banks across tenures. The impact of this current higher interest rates is not likely to be limited to near term. HDFC Bank is raising/raised costly deposits for periods ranging from 4 to10 years and the impact of this will be felt over the similar time frame.

The third whammy likely, RBI has started lowering of rates from Feb 2025. Major Loan rates will reduce immediately as most are floating rate loans, whereas FDs are at fixed rate of interest. This will lead to lower NIMs for the Industry for some time. But for HDFC Bank, slow growth of advances, high cost of funds and reducing margins is a deadly cocktail, which will continue to higher impact profitability for next 2 to 3 years at least.

GNPAs

HDFC Bank used to have consistently low GNPAs (defaults or Gross Non Performing Assets) in the Industry of around 1%. Post merger, HDFC Bank GNPAs have increased by 21%, from 1.12% to 1.42%. ICICI reported reducing GNPAs from 2.78% to 1.96% in same period and also RBI said, “GNPAs, are at 12 year lows in the Banking Industry in September 2024 on the back of falling slippages”. HDFC Bank on the contrary has reported is highest GNPAs in 10 years at 1.42%. The biggest jump in GNPAs is in Wholesale segment up from 0.4% to 1.7%. This is probably due to merger-indigestion. The provision coverage ratio which was at 75% pre-merger is at 68% now. If this was maintained at 75%, profitability metrics would have taken a further hit!

Combined effects of the Above?

The combined effects of the indigestion and the medicine for the same resulted into slowest growth of Profits at 5% in 18 months. This is the slowest growth in last 10-15 years. In contrast ICICI PAT increased at 16% in the same period.

The other profitability metric in a Bank is Return on Assets(RoA). HDFC Bank reduced profitability has led to RoA falling from 2.1% to 1.87% between Pre-merger (June 2023) and December 2024 a fall of 11%. (ICICI Bank reported stable RoA in the period). This fall was cushioned by Non interest Income increasing by 23% from pre-merger levels and lower denominator of Assets(slowing advances growth).

What does the above add up to?

Most key metrics have shown not so good performance compared to its own past performance or its similar size peers. To its credit, even at the lower performance, it still compares reasonably well with many large Banks.

A large part of the drop can be attributed to the merger. HDFC Bank Board would be aware of the likely indigestion but might not have expected it to hit as hard. The merger between HDFC and HDFC Bank was 2 large companies and any such merger across Industries does lead to Indigestion in the merged entity. But in Banking, the impacts (side-effects) of the medicine (twin strategies), quality of the book of the entity merging and combined with the weakness caused due to the prolonged indigestion, has seen the performance on key parameters fall. HDFC Bank says, that it is likely to start growing credit equal to Industry in FY26 and faster in FY27. But the lag effects of indigestion & medicine will continue for longer time. The real indicator of HDFC Bank being partly cured of indigestion would be NIMs, RoA, GNPAs hitting premerger levels all together. The earliest one would expect the same would probably be in FY27.

HDFC Bank had for a long time been India Inc’s top performer with QoQ and YoY growth rates at stable 12-15% on key metrics. Will FY27 to FY30 period see HDFC Bank get back into the similar rhythm (fully cured)? Wait and watch for next 5 years!

We do hope you have enjoyed reading this issue of the Chai and Charts Chronicles. Do share your feedback in response to the post or directly to the author at menghrajani1@gmail.com

In case you have missed any of our earlier posts, you can read them by clicking here.

Indigestion due to merger of tow mega entities well articulated using the relevant ratios! As a shareholder of HDafC bank, I am more informed why the elephant has still jnot started dancing!!! Thanks to the author!