Financial performance or Credit Rating or Stock Price - Which is a better indicator of the "health" of a company?

One can argue that all of them are indicators and should be considered collectively, but what if all of them are not talking the same language for a company over a longer period?

One can argue that each of the 3 aspects viz. Financial Performance, Credit Rating and Stock Price address different stakeholders and hence cannot be really compared. But is it really true?

Financial Performance - Revenues and Profitability over longer tenure of 5-7 years give a sense of how sustainable is the performance of the company

Credit Rating - It is an indicator of how likely is the company of repaying its liabilities over the tenure of the debt. This is derived from the current performance and projections for the future prepared by the company themselves. Credit Rating gets adjusted periodically up or down based on the performance. The trajectory of the credit rating of long term debt provides a good understanding of the performance

Stock Price - The stock market factors in what the next 1-2 years performance is likely to be and share price moves based on the same. Any immediate events with positive or negative impacts on the company, also trigger a downfall or increase in share price. Hence again long term the stock price should reflect the fundamentals.

Thus all Credit Rating and Stock price are related to financial performance and should be “directionally similar”. And we are not talking of at a point in time, but over 4 to 6 years, thus removing any lag in any of the aspects, getting addressed and hence the long term trajectory of all 3 should be similar.

Let us see all 3 aspects for Tata Motors Ltd and get a sense of whether the theoretical hypothesis is true.

All the 3 aspects for Tata Motors discussed here are at a consolidated level only which includes all Indian operations as well as JLR operations globally.

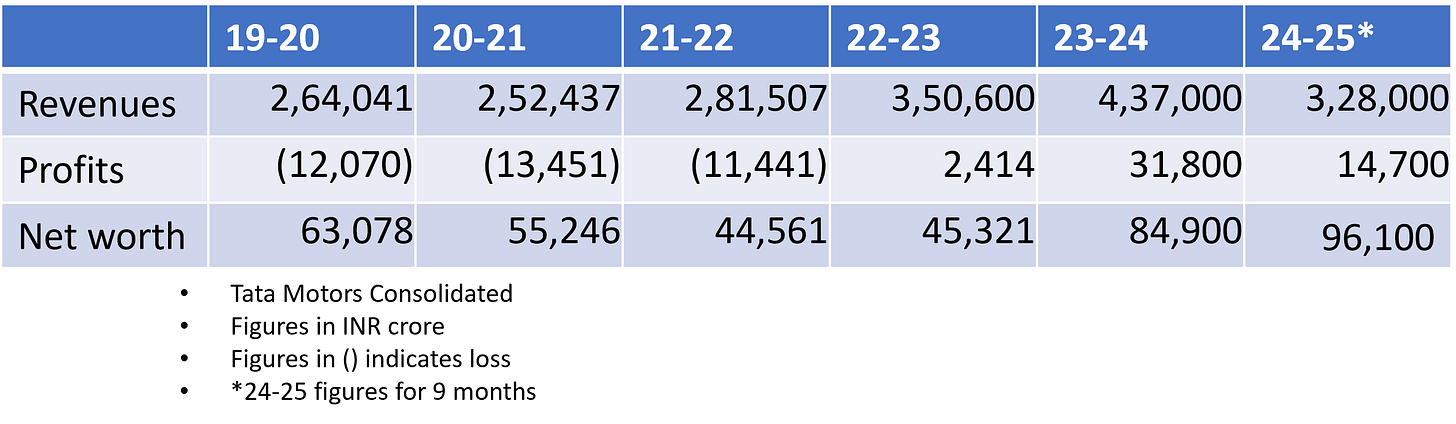

Revenues and Profits

In 22-23, TML reported positive growth in revenues after 4 years of declining revenues from 18-19 to 21-22

For 5 years till 22-23. TML reported negative or almost nil profits

Only in 23-24, it has reported jump in revenues and profits. In 24-25, it has had muted performance in 9 months

The Net Worth declined for 5 years from 18-19 to 22-23

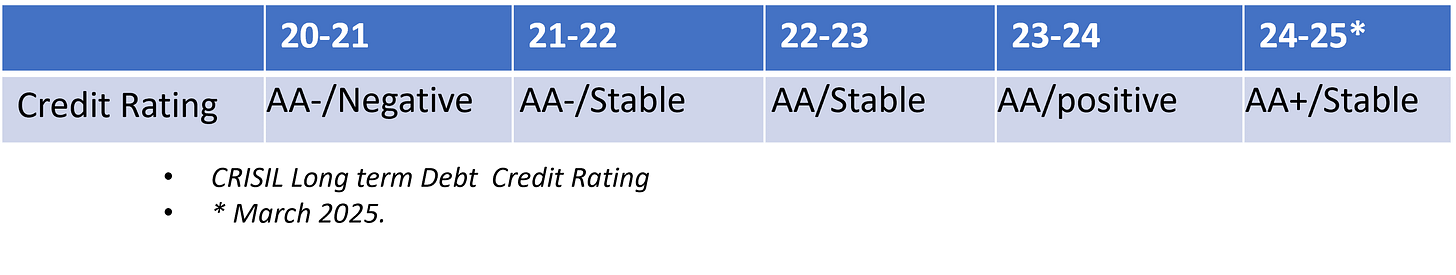

Credit Rating changes

The credit Rating has however shown slow but steady improvement over the period from AA-/Negative to AA+/Stable. Currently, It is just one upgrade from the highest rating AAA!

Even when Revenues and Profits in 20-21 and 21-22, were lower than even 14-15, the credit rating marginally improved

Stock Price

The share price has shown steady increase from October 2020 to 2024 to all time high in July 2024

This is despite 4 years of declining Net worth till 22-23

In 18 months from December 2022 to July 2024, the share price increased by 200%

From August 2024 to April 2025, Share price has reduced by 50% to reach a 2 year low, despite

the Net worth has been at an all time high,

Revenues and Profits at or close to all-time high,

Credit Rating improved to AA+

EPS at all time high of Rs 43 after 9 years,

What does all the above indicate?

Is Share price therefore an early indicator of future long term performance? As was visible in 22-24 period when it increased by 200% well before the growth in revenues and profits?

Tata Motors is a RARE stock!

As a corollary, how does stock market know about future performance of the company? More reliably than credit rating agencies?

And while the stock market was bullish, Credit Rating agencies armed with lot of confidential data (which is not available in public domain) of future projections from the company, did not radically improve the rating!

And as a corollary, what does the “gradual” fall of share price to 50% in last 8 months indicate? Is TML likely to report lower revenues/profits in Q4 FY 25 and FY 25-26?

The Trump effect if any on the price would be only after February 2025, but the fall has already been happening 6 months before that

The Credit rating agencies continues to be optimistic. On 5th March 2025, CRISIL, has reaffirmed AA+/Stable ratings. In the Rating rationale of the same date, it mentions- “TML should continue to benefit over the medium term from its high sales volume, improved profitability in JLR and mix and steady volume growth, improved mix and cost-control measures. Business and financial risk profiles are expected to remain robust, with healthy sales volume and better operating margin generating robust cash flows for deleveraging”.

In that case, why is the stock market pessimistic? On 7th March 2025, TML share price was Rs 650, same as on 24th April!

Are Performance, Credit Rating and Share price of TML - Directionally similar over the 5-6 years data we saw earlier? What do you think? We hope to get some “directional” answers when TML declares its results for Q4 FY 25 on 13th May 2025!

We do hope you have enjoyed reading this issue of The Chai and Charts Chronicles. If you like it, please share the same with your friends and colleagues and if you have not liked it, please share the feedback with the author at menghrajani1@gmail.com

In case you have missed any of our earlier posts, you can read them by clicking here.

Sensible analysis of the three key factors. While P&L indicates the past performance, Credit rating is a measure of past and anticipated future performance. In my opinion, the stock price logically should be an indicator of the future performance as the past performance is history and already factored in the stock price. Appreciations to the author on bridging out this article. Eagerly awaiting more articles from him.