Divergent Approaches to Organised Retail by 3 Top Business Houses in India

Tata Group, Reliance and Aditya Birla Group, 3 large Business Houses have significance presence in Organised Retail. But with quite different approaches.

Modern Trade (MT) refers to the organized retail sector characterized by large-format stores, supermarkets, and hypermarkets. It also is largely company owned and operated brand stores with a few being franchise stores. It contrasts with traditional trade channels and emphasizes a more structured, centralized approach to retailing. Today this has morphed further into what is termed Omni channel, with a dominant Brick and Mortar presence supported by Digital channel.

Modern Trade today in India encompasses several segments with the biggest one being Fashion/Apparel followed by Grocery/FMCG, Jewellery, Consumer Durables, Pharmacies and more. There are very few segments of the market where Modern trade has not penetrated. India has several players operating individually in each segment like Raymond for Apparel, TBZ for Jewellery, Vijay Sales in Consumer Durables, D’Mart in Grocery/FMCG, Lenskart in Eyewear, MedPlus in Pharmacy and so on. At the same time, Tata, Aditya Birla and Reliance have had presence in multiple segments. The approach followed by each of these has been different and hence provides a good case study in approaches to Organised Retail.

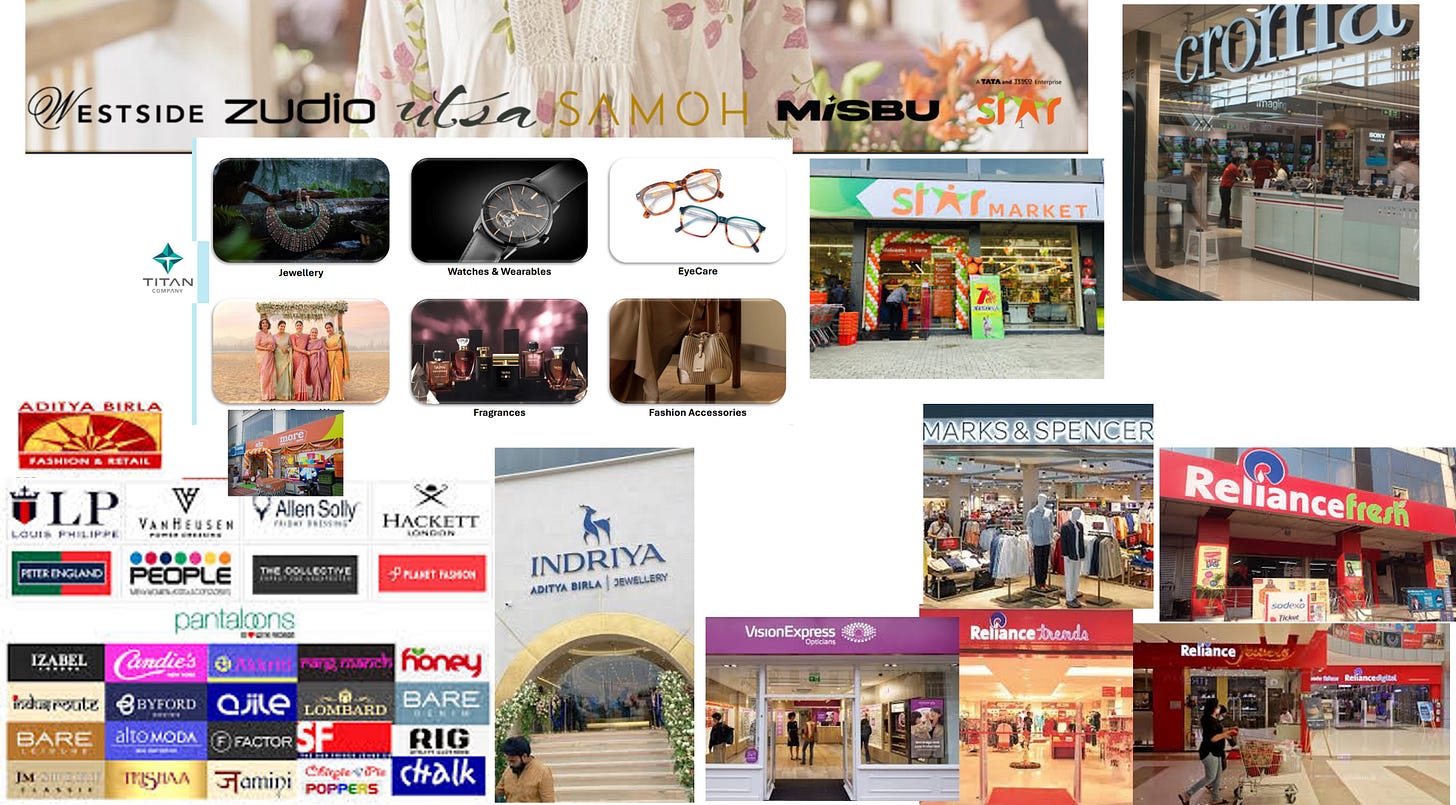

An overview of the retail presence of the 3 Groups

Over the years, these 3 groups have straddled different segments with varying degrees of success and continue to explore new segments.

The divergent approaches

Presence across multiple segments

Tata and Reliance operate across a large swathe of segments

Aditya Birla Group operates in Apparel, Footwear and Newly launched Jewellery. It used to run “More” in FMCG/Grocery from 2007 to 2019 (It was sold to a firm in which Amazon has 49% stake)

Overall Governance

Tata has multiple companies for different brands, Management teams, Boards and all the companies operating Independently.

Reliance has a Umbrella entity Reliance Retail under which it operates all the brands/stores. At the highest level, there is a common Management and Board

Aditya Birla has 2 main entities - Fashion & Lifestyle (ABFRL) and Jewellery

Joint Ventures

Tata has two JVs - Tesco for FMCG and Zara for high End Apparel both of which are quite small. Croma started its journey as JV with Woolworths of Australia in 2006, but the partnership ended in 2012.

Reliance has large number of JVs and partnerships with International brands such as GAP, Armani, Burberry, Diesel, GAS, Marks & Spencer, Superdry, Brooks Brothers, Steve Madden, Hamleys and more. Reliance also has JVs/partnerships with Indian fashion labels such as Satya Paul, Manish Malhotra and Ritu Kumar over the last 3 years. JV with Clarks for footwear ended in August 2024.

Aditya Birla owns/licensee for all the Brands in which it operates. It also has strategic partnerships with Indian designers - Masaba, Tarun Tahilyani, Sabyasachi Mukherjee all of these are 1 to 3 years old. ABFRL has long-term exclusive partnerships with select brands such as Ralph Lauren, Hackett London, Simon Carter, Ted Baker, Fred Perry, Forever 21, American Eagle, Reebok and Galeries Lafayette.

Approach for entry into Organised Retail

Tata group entered each segment as an Independent Businesses, All have been Greenfield ventures and launched at different points in time - Watches - 1988, Jewellery - 1996, Apparel - 1997, White Goods - 2006, FMCG/Grocery - 2004, Eyewear - 2007, Coffee shops - 2013

Reliance entered Organised Retail in 2007 as a Big Bang entry into multiple segments simultaneously as greenfield venture with investments of Rs 25000 crore

Aditya Birla journey was through Acquisition - Madura Garments(Apparel) in 1999, More - FMCG/Grocery in 2007, Pantaloons in 2012, Reebok - 2021. Indriya its Jewellery foray is a greenfield venture

Growth

Tata - All the companies despite independent management have had calibrated growth. It has also been criticised both internally (within Tata Group) and externally as being conservative in the booming retail sector. Star Bazaar started in 2004 and in 20 years has 72 stores across formats, Westside in 25 years has 228 stores, Croma in 18 years has 500 stores, Taneira - 73 stores in 7 years. Zudio however grew very fast to touch 500 stores in 7 years. A total of 5000 stores across companies, segments, formats over 26 years. The plus side to this approach is much fewer store closures (Zudio closed 16 stores in just the JAS Qtr!) across segments and more profitable segments (FMCG/Consumer Durables are the only ones loss making).

Reliance - Big Bang approach to store openings. In just about 17 years, it has over 18000 stores across segments and formats. The downside is larger number of stores closed. In June 2024 quarter, Reliance Retail closed 230 stores due to poor operating performance. While profits by segment are not publicly available, most segments might be making losses or small profits (despite the scale), resulting in headcount reduction of 38,000(15%) employees in 2023-24

Aditya Birla - 4600 stores in Apparel in 25 years. Indriya has opened 10 stores in 4 months since launch July 2024 and plans to go to 100 stores by December 2025. Reebok relaunched in October 2023 has 169 stores and plans to touch 300 stores in 18 months. In FMCG/Grocery Aditya Birla went from 172 (acquired) stores to 550 in 12 years. In 2019, it “closed” FMCG/Grocery “More” by selling the Business due to losses to an Amazon JV.

Branding philosophy

The retail businesses are all independent brands in themselves. Titan, Tanishq, Westside, Croma Star Market etc. and well known. There is no umbrella brand or guidelines. Brand guidelines exist at Individual company level - Trent, Titan, Infiniti

Reliance has a common Umbrella branding with all brands having Reliance as mother brand with the respective segment as a suffix - Reliance Jewels, Reliance Trends, Reliance Mart and so on..

The JV stores on the contrary mostly carry the foreign partner Brand - M&S, Hamleys .…

Aditya Birla had acquired most of the Retail Business and hence these have been retained a distinct Brands.

Cannibalising/Competing within the Group

Tata has multiple overlaps:

Ethnic Indian wear with Taniera by Titan and Samoh by Trent.

Croma competes with Voltas through own private labels in Refrigerators, ACs, Washing Machines.

Star Market competes with Tata consumer with its own Fabsta brand for Tea, Coffee, Dals, Dryfruits, Packaged drinking water and more - All of them displayed next to each other in Star stores, both claiming to be Tata Products and Star products priced with 20 to 40% lower!

There is degree of overlap between Tanishq and Caratlane (Both part of Titan)

Reliance by contrast does not “compete” with itself in the different segments of Retail, given its branding and governance philosophy

Aditya Birla has multiple competing Brand/stores - Louis Phillippe, Van Heusen, Allen Solly, Peter England - All formal wear brands with slightly different price points. The segments each of them target overlap and hence these brands compete amongst themselves also.

Physical presence

Tata

Almost all Retail store Brands are available only in the respective Brand Stand alone stores(SAS). The exception is ZUDIO which is also present as Shop in shop (SIS) in Star stores

It is very common to find multiple Retail brand stores across segments available in a same malls.

Synergies/cost advantages in property leasing amongst companies is almost non-existent

Reliance

All segments are either available as SAS or SIS in other Reliance Brand Stores

It is very common to find multiple Retail brand stores across segments available in a same malls. All Real Estate purchases/leasing are centralised for scale benefits

Aditya Birla brands of Apparel are available in over 37000 Multi brand outlets, apart from 4500+ own brand stores (SAS) and over 9000 SIS. It is quite common to find different brand stores of ABFRL in the same mall and even sometimes opposite each other and hence directly competing.

Online Presence

Tata - The Retail Brands are largely available only on company Digital platform or Digital apps of the Tata Group. The company digital platforms like StarQuik(part of Star Market) for FMCG/Grocery compete with Big Basket also owned by Tata.

Reliance - The Retail Brands are largely available only on company Digital platforms

Aditya Birla - The retail fashion and lifestyle brands are available on the company owned Digital channels as well as Marketplace companies Amazon, Flipkart, Tata Neu

In various segments, the leaders in revenue terms are different companies

Apparel/Fashion - Aditya Birla Group

FMCG/Grocery - Reliance

Jewellery - Tata

All the 3 Groups have announced intention to grow share of the consumer facing Businesses significantly. With the advent of E-commerce first and then Q commerce, the Organised Retail is facing challenges. Apparel and Consumer Durables were significantly impacted by Amazon/Flipkart and like earlier itself, FMCG/Grocery is being impacted by Q commerce. The moot point however is that the E and Q commerce channels are growing by offering discounts and making losses. How long will it last? And while it lasts, will it sound the death knell of Organised Retail? The Big daddy of Organised Retail in India Big Bazaar started in 2001 and grew very rapidly across formats and segments and also closed rapidly in 2023.

On a parting note, One of the very few sectors where Foreign Direct Investment is restrictive in India, is Multi brand Retail. Walmart and many other Global Organised Retail chains have been waiting in the wings hoping for a change. Central Government passed laws in 2012 allowing 51% FDI in Multi brand retail, but with a caveat - the respective state government has to pass law to allow it locally. Most BJP ruled states like Gujarat, MP, Rajasthan, UP and opposition states like WB, TN etc. do not permit FDI in multi brand retail. If Walmart, Carrefour, Tesco Aeon, Target and many more were to operate in India, would the Indian companies in Organised Retail have thrived/ grown as they have?

If you like this, please do share this with your friends and colleagues. In case you have missed any of our earlier posts, you can read them here.