How much can one order impact a $ 30 billion IT services company?

On April 8th, Tata Consultancy Services (TCS) reported results for FY25 with increase in revenues by 6% and drop in Gross Margins by 1.5%. What could have caused both the increase and drop? BSNL?

Disclaimer: TCS does not disclose client specific revenues/profitability in public domain. The author has triangulated data from TCS investor presentation/fact sheets and news interviews by TCS management to assess the impact of BSNL order on TCS top and bottom line to present a picture. The actual numbers might vary slightly.

What was the critical cog in the TCS wheel in FY25?

We rewind to May 2023:

A May 2023 press release “The consortium led by Tata Consultancy Services Ltd has received an Advance Purchase Order valued over Rs 15,000 crore($1.8 billion) from BSNL, a 100 per cent Govt. of India owned Public Sector Undertaking, for the deployment of a 4G network across India,”

TCS, in collaboration with the government's Centre for Development of Telematics (C-DOT), will make a total of 38 deployments of varying capacities in BSNL premises across all telecom circles of the company as part of its 4G network deployment, making it the first indigenous network solutions provider

As per the deal, TCS will set up large data centers in the four regions pan-India. It entails installation of two large data centers which would be primary and disaster recovery servers across the four regions and additionally setting up of as many as 30 data centers in each telecom circle. The order to be executed in less than 24 months

The order is “hardware(h/w) intensive”

Rarely does an IT company (TCS revenues in FY 23 were $ 26 billion) get a $ 1.8 billion dollar order to be executed in less than 24 months. So matter of rejoicing! Because, an individual Large customer annual revenues for companies like TCS are in the range of $100-200 million. So what is the impact of such a huge order executed in “short period”?

Impact on TCS in FY25

Revenues

In FY25, TCS Global revenues increased by 6% YoY in INR terms with most geographies increasing by +/- 2-3%

India Geography grew by 63% in the same period. Thus 59% of 6% Global revenues increase in FY25 was contributed by India Geography.

India revenues in FY23 was Rs 11,270 cr which increased to Rs 21,957 cr in FY25. There was no other “large” order received in India Geography in this time frame

BSNL order which started execution from Q3 23-24 had a large portion executed in FY25

Hence, India Geo growth and Global revenues growth in FY25 have been largely driven by BSNL. BSNL contributed to approx. 5% of Global revenues in FY25, making it single biggest customer for TCS in FY25 (And probably in a long time). More than $1 billion of the $30 billion revenues by one customer!

This is corroborated by statement from TCS - In January 2025 TCS said it is poised to navigate the anticipated revenue downturn from its substantial BSNL contract by exploring multiple new opportunities, both domestically and internationally. But it did not specify the impact and by when can it navigate?

Margins

An IT Services company makes much higher margins than IT hardware companies like DELL/HP/CISCO and the likes, given that margins in “Services” are high due to “value addition” and off shoring providing a booster to margins.

In orders which are a mix of H/W and Software/Applications, the margins tends to be lower with H/W component pulling down the margins

H/W supply tends to be low margins as there is limited “value addition” in this component by the System Integrator(SI) like TCS

The BSNL order for TCS was “h/w intensive” including setting up of Data Centres and mobile sites across India

TCS procured h/w from various companies including its sister company Tejas Networks and provided SI services. This h/w intensive order would result in depression of overall Gross Margins at company level

In January 2025, "The same program (BSNL) as it tapers down at a portfolio level, at an overall level, there would be a benefit which would come in (on margins)," TCS CFO Seksaria said replying a specific question on the impact of BSNL deal's tapering down on margins

But how much was the margin compression due to BSNL?

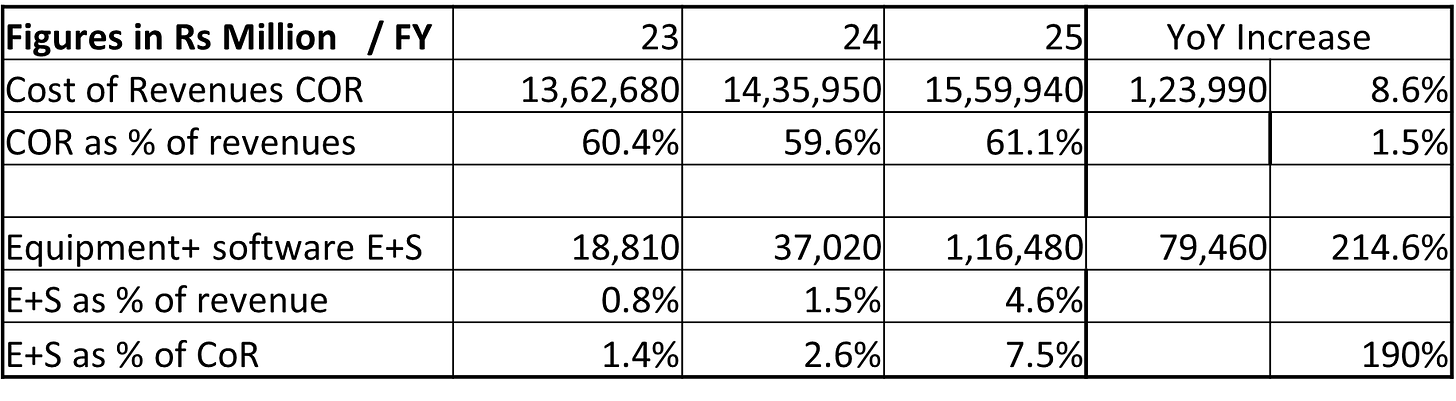

The table indicates that TCS reported margins compression by 150 bps in FY25. But does this tell the full story and what was the contribution of BSNL order?

BSNL order was H/W intensive, which meant, that TCS procured H/W and supplied it to Customer

TCS reports “Equipment and S/w under two parts”

One is under Cost of Revenues(CoR) where the purchases are on behalf of customer and secondly in SG&A, under Depreciation when the purchases are for own internal use

The data of CoR is shown in the table below:

Purchase of E+S for Customer order increased by 214% in FY25 (Mirroring the India Geo revenue increases) and the E+S as a % of CoR increased from 1.5% in FY 24 to 4.6% in FY25

Hence this increase in h/w purchase was largely due to BSNL order. Hence the direct margin compression due to this alone is around 300 bps

The margins on the service component of BSNL would also be lower as India Geography does not provide “offshoring and dollar appreciation booster to margins”. Thus the overall TCS margin compression due to BSNL order would be around 400 to 450 bps

But the overall margin compression reported by TCS was only 150 bps? TCS managed to reduce expenses under other items of Cost of Revenues to soften the impact of BSNL order on overall margins

Overall positives

BSNL was the single biggest order for TCS being executed in less than 24 months.

To put it in perspective, Passport Seva project that TCS renewed in 2022 is valued at $1 billion but executed over 10 years

Most overseas Billion dollar deals have execution time frame of 7-10 years

$ 1.8 billion BSNL order could be completed in less than 2 years, only because it was h/w intensive order

At TCS annual productivity of Rs 40 lacs revenue/employee, TCS would have required 50,000 employees only for executing BSNL order (TCS total employee base was 6,00,000 in March 2025) if it was pure services order of the same magnitude. But TCS managed it with a much smaller team due to large H/W component! But…

TCS overall productivity improved by 7% (really?) in FY25, partially boosted by h/w intensive BSNL order

Overall negatives

TCS Global revenues in FY25 growth excl BSNL was muted, thus demonstrating overall weakness

The margin impact was reduction of 400-450 bps

But TCS was able to partially mitigate the impact by reducing the other components of Cost of Revenue and also supported by weakening rupee (Rupee depreciated by 2.5% vs US$ in FY25, which aided margin improvement, given than 92% of TCS business is foreign exchange denominated)

A large part of H/W for BSNL order was procured from Tejas Networks, a company majority owned by Tata Group. Tejas Networks revenues in FY25 (9m) increased by 500% (Rs 1200 cr to Rs 7000 cr) and profits improved from loss of 132 crore to 743 crore profit in the 9 months FY25, largely due to BSNL order! (Some margin losses of TCS compensated through Tejas Networks!)

The annual report for FY25 when available would provide more details of this Related party transactions

On a parting note: The analysts tracking TCS, have opined that TCS should quickly replace BSNL shortfall with other big order. But “services” order of this magnitude ($1.8b revenues in completed in less than 2 years) is an impossibility. Should TCS aspire for a “similar” order executed quickly with fewer people, but at substantially lower margins? Or focus more on services which might provide lower faster topline growth, but stable annual revenues and at higher profitability? What is your take?

We do hope you have enjoyed reading this issue of The Chai and Charts Chronicles. If you like it, please share the same with your friends and colleagues and if you have not liked it, please share the feedback with the author at menghrajani1@gmail.com

In case you have missed any of our earlier posts, you can read them by clicking here.