Are Indians Shying Away From Insuring Themselves?

The Changing Dynamics of the Life Insurance Business

We are back with another edition of The Chair and Charts Chronicles. We hope you like the newsletter and are reading it with a Hot cup of Chai (Tea) or Coffee which you prefer.

In this edition, we will cover a different facet of the changing dynamics of the Life Insurance Industry.

Before we dive deeper into the charts, let us give a brief overview of the Life Insurance Industry in India to you.

The Introduction

As most of you know, from 1956 onwards India had only one Life Insurance company viz. LIC of India (LIC). Post 2001, the private sector was allowed to set up Life Insurance Companies. As of November 2023, there are 25 companies in the private sector apart from LIC. It is a fact that with the advent of competition, the Market shares of dominant players shrink. Today, we will dig deeper into the extent of the changes in the market, not just from a Market-share perspective but some other factors that are indicating the rapid pace of changes in the Life Insurance Industry.

The entry of the Private sector has benefited the Industry in India. Insurance penetration and density are two metrics, among others, often used to assess the level of development of the insurance sector in a country. While insurance penetration is measured as the percentage of insurance premium to GDP, insurance density is calculated as the ratio of premium to population (per capita premium). India’s Insurance penetration has increased from 2.71% in 2001-02 to 4% in 2022-23, Insurance Density has increased from US$ 69 in 2001-02 to US $ 92 in 2022-23, indicating that there has been growth in the industry. We will analyze the pattern of this growth from multiple angles.

The Life Insurance market is broadly categorized into Individual and Group. Individual as the name suggests is where each individual chooses which Insurance company, period, sum assured, etc. whereas Group Insurance as the name suggests is significant Insurance of Group of Individuals by an entity like a company insuring its employees. Under Individual Life Insurance, there are 2 broad categories as classified by the industry viz. Individual single premium and Individual Non-single premium. The industry calculates the market share of Individual businesses as a WNBP (Weighted New Business Premium) where the Individual single premium is assumed for 10 years and WNBP is therefore Individual Non-Single premium +10 % Individual Single premium. The term Individual premiums is the term used for New Business Performance in a period and is the premium collected in a period for new policies issued in that period. Renewal premium is a different aspect of the Life Insurance Business and we hope to cover this in one of our subsequent editions of the CCC.

Our Analysis

For our analysis, we focused on Individual Non-single policies for New Business performance. This is primarily due to:

Individual policies are the ones where each one of us chooses the Insurer, tenure, and the sum assured

Individual Single premium on a WNBP basis is less than 5% of the Annual New business premium

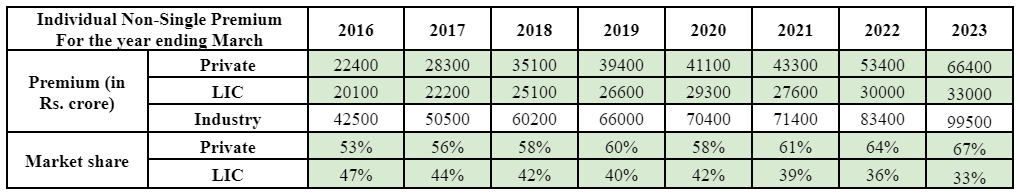

For the last many years, media headlines have said that Private sector Life Insurance companies have been eating away at the market share of LIC. The pace of change has however increased significantly as the table below shows. The overall industry has grown at 17% YoY(Annual New Business Premiums) over the 8 years whereas LIC has grown at 7% YoY and the private sector has grown at 25% YoY.

(All data used in this article has been sourced from the website of Life Insurance Council which is the association of all Life Insurance companies operating in India.)

But this is just one part of the story and is probably well understood also. But there are other aspects of change which we will discuss below.

A Handful of Private Sector Companies Dominate

The growth of the Private sector has been dominated by a handful of companies. In the 8-year period till 2023, the Top 10 private sector companies combined have a 91% - 93% share of the New Business with the rest 12 to 15 companies having just about 8% in all the years and even within the Top 10, the Top 5 have close to 65% share of the Private Business and they continue to be the same 5 companies over 6 years as can be seen from the table below.

While Insurance penetration and density are amongst the key metrics that measure the growth of the industry, they are calculated on Premiums in relation to GDP or population.

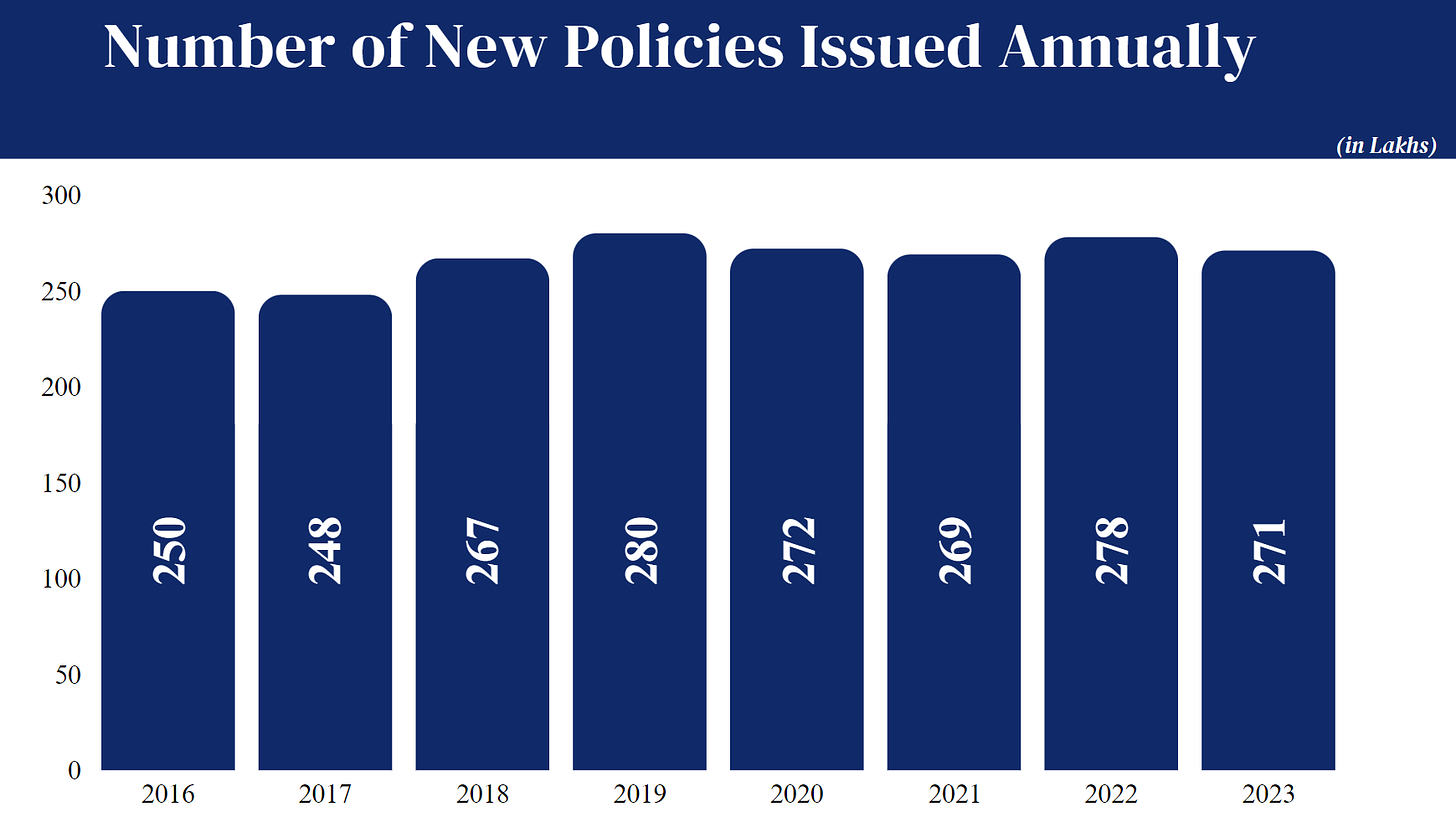

There is another dimension in a country like India which has low penetration and density is the absolute growth in the number of new policies issued (which is probably a surrogate for several new people getting insured. (Remember, I can buy 2 policies 1 each from A and B life insurance company and it will be counted as 2 and if next year I purchase another policy from A, it will be a new policy. There is no publicly available information on the number of Indians as a % of the population who have a life Insurance policy). The data of new policies issued from 2015-16 to 2022-23 is shown below in the chart.

It has been a muted growth from approximately 250 lakhs to 271 lakhs with it touching 280 lakhs between 2018-19. So, while new business premiums have increased from Rs. 42500 crore to Rs. 99500 crore an increase of 134%, the number of new policies increase in stark contrast is less than 10% in the same period.

This is only possible due to an increase in the premium amount per policy. A Life Insurance company arrives at the premium amount based on various factors, but the 3 most important parameters are the tenure of the policy, the sum assured, and to an extent the insurer's age at the time of purchase of the policy.

The premium per policy for the industry has grown from Rs 17000 per policy to Rs 36000 per policy. Yes, it means that the average new policyholder is paying an annual premium of Rs 36,000 as compared to Rs 17000, 8 years ago.

Now, what is causing this change?

The demographics of the country have not altered substantially in the last 8 years, hence the most plausible explanation for the increase in the premium per policy is that Indians on average are insuring themselves for higher sum assured.

Reading it in isolation is good as firstly India has traditionally higher inflation rate and secondly, because of growth in the economy, the buying power of Indians is increasing.

But when combined with an extremely low increase in the number of new policies does create a cause for worry, especially in a country like India which has low penetration and is the world’s most populous country.

Hence the question is: Are the people who are relatively better off insuring themselves for higher sum assured, whereas those relatively less well-to-do are not insuring themselves?

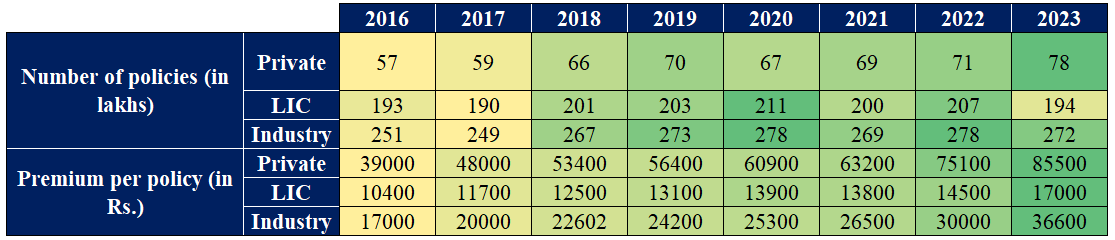

A further analysis reveals an interesting pattern as shown in the table below.

Over the 8 year period, The number of policies issued per year by LIC has been more or less stagnant at around 194 lacs, whereas the private sector has increased from 57 lacs to 78 lacs policies issued annually, indicating a measly growth of less than 5% annually.

Private sector companies had a much higher premium per policy in 2015-16 as compared to LIC by almost 3 times (Rs 39000 as against Rs 10400)

The gap has widened to almost 5 times in 2022-23 at Rs 85500 against Rs 17000 of LIC.

Could it be that LIC customers are insuring themselves for a lesser sum assured or LIC is catering to a relatively lower-income segment of the population? Or the relatively well-to-do, are opting for private insurance companies?

Or the private sector companies are primarily targeting higher value policies only (given the data indicates an average premium increasing from Rs 39000 per policy/per year to Rs 85500 per policy/year) and catering to a very different segment?

ULIPs are not the reason, as till around 2010 private sector companies had a high focus on ULIPs, but after the regulator clamped down on the mis-selling of ULIPs, ULIPs have been relatively a small part of the Business

LIC is not just losing its Market share based on New Business premiums but on other elements like number of new policies issued and a premium per policy.

The dynamics in the Insurance business are changing in more ways than one. The question also is should the Regulator do something about it, especially to the fact that despite 26 companies, the number of new policies in a year has been stagnant in the 8 years?

Hope you enjoyed reading this edition of The CCC as well as the Hot Chai (Tea) or Coffee you had while reading this. If you like our newsletter, please share it with your friends or colleagues whom you believe might also like to read this. While we enjoy your “Likes” on our pages, when you refer to someone else, it makes our day as that is a much better indicator of you liking our work!